Assessing Cannabis Retail Markets: Grades for Success

It's not easy to talk about the cannabis industry as a whole. That’s true when we talk about culture, product performance, or whether we’re discussing retail trends and best practices. Each state market in the cannabis industry exhibits unique characteristics and challenges. As the leading commerce technology and point of sale provider across more than 13 states, Treez is in a unique position to categorize the cannabis retail markets of the United States and grade them on current market activity and future prospects.

These grades reflect the current performance of each retail market as of May 2023, taking into account sales trends, as well as, variables both in and outside the direct control of cannabis retailers and dispensaries. We also categorized state markets into distinct buckets based on their different phases: new or emerging, saturated, and oversaturated.

As the industry continues to evolve, stay tuned to Treez’s blog for more updates and analysis. Like your favorite professor, our grades are tough but fair, and as we grade we’ll offer plenty of opportunities to improve your marks before the final. So sharpen your pencils and get ready.

Let's begin with the first category:

Market 1: New/Emerging

Examples: New Jersey, New York

Grade: C (NJ: C+, NY: D)

New and emerging markets like New Jersey and New York are full of both opportunities and challenges for cannabis operators. The number of operators cleared to sell is still frustratingly low within both markets, which means there is high demand for cannabis from those retailers that are open. Early-to-open retailers will reap the benefits of that demand as supply will be limited. But don’t be fooled – that dynamic can change quickly and lead to saturation and pricing compression as you’ll see further down. At the same time, the market faces challenges including the lack of market research or data to reference during planning and strategy sessions.

And of course, notoriously slow and bureaucratic processes are impeding operations. In some cases, operators are prevented from opening for many months to over a year due to delays and policy changes from state, city, and township regulatory boards. Funding promised to social equity and conditional adult use dispensary license holders have yet to materialize, as of the time of this publication. In New York, the state has awarded 215 retail licenses to date, but only 12 legal adult-use dispensaries listed as open for business on OCM’s official list, several of which are within direct foot traffic competition with one another. A variety of factors have led to a painfully slow rollout in these markets, and allowed the illicit market to continue to flourish in its stead, making it even harder for legal stores to get their footing. Treez predicts the New Jersey and New York market will remain in this emerging stage for at least the next 9-12 months.

The Basics:

Without years of history and brand recognition to compete within the legal market, operators have a unique opportunity to quickly establish themselves as prominent players and become the household name in their area. To achieve this, they need to distinguish themselves from the pack. The most successful operators in a new or emerging market will, as much as possible, create a recognizable and differentiated brand, with a unique experience and product offerings. That way, even the most casual consumer that fits the retailer’s ideal customer profile has the opportunity to become a repeat customer.

Operators will also need to keep up with the demand of a new and emerging market in order to find success. Customers in new markets are still figuring out their preferences, so operators must be ready to cater to their needs. They’re likely “shopping around” for their preferred shop and not yet settled into their buying patterns.

Operators also must make sure all their systems and standard procedures comply with state tracking systems from day one. Compliance issues, such as overselling or missing inventory, can jeopardize a store’s sales when a regulatory board halts sales or levies a hefty fine before an operator has a chance to compete.

Losing out on even a day of sales can spoil an operator’s chance at success in a new market. Selecting reliable systems and software with excellent uptime is crucial to avoid profit loss due to interrupted sales. Customers in new and emerging markets tend to be exploratory, not yet settled into their preferred cannabis retail destination. If they can’t buy from one retailer, an unattached customer might move on to the next store, and Retailer One may never get another chance to impress that customer.

The More-than-Basics

Now that we’ve covered the basic metrics an operator in a new market should consider, let’s consider ways that someone operating in these passing markets could set themselves up to be an A+ operator.

Provide the best consumer experience

Operators can differentiate themselves by delivering an exceptional experience at every touchpoint. This includes:

- Aesthetics and Curb Appeal: how a customer accesses the physical store and what they see from the curb when they arrive

- Flow and Ambiance: what flow they follow on their purchasing journey inside your physical location

- Web Design and Content: The visuals, language, and media that greet customers when they visit your website

- Ease of Purchasing: how a customer purchases products from you online, through an app, a marketplace, or a store website

- The Right Stuff: the right product assortment and SKU count

Developing a unique brand

Operators that stand out more in mature and oversaturated markets owe some of their success to the time they took in the beginning to create a distinctive and memorable brand identity. Having brand recognition begins with creating a unique brand that follows a cohesive strategy, including from the name, to the logo and colors used, to the brand voice that your brand “speaks” to its customers in, whether that be in-store through signage or employee scripts, online on social media or your shopping website. The stronger and more clear that a retailer’s brand strategy is, the easier it will be for a new consumer to latch on to the brand.

Utilizing data for informed decision-making

Operators in new and emerging markets are facing a future of a saturated market. If they can use the initial demand and emerging periods to collect data and insights on their ideal customers’ shopping habits and preferences, they will set themselves up for success.

Operators in new markets must leverage data to understand:

- Consumer Preferences - preferred shopping type (online, kiosk, consult); busy hours and days; preferred payment type

- Product Performance - most popular brands, product types, branding style; what prices the customer base can and cannot tolerate, measured by how fast products sell and how fast you need to replenish (sellable velocity)

- Budtender Effectiveness - which budtenders are able to upsell, which are skilled at fast transactions, which budtenders have the fewest returns, what times or days need more or less coverage

If they spend the time well and collect as much high-quality data on their operations as possible, operators in new and emerging cannabis markets like New Jersey or New York will be able to define their business’ strengths and refine their weak points before the truly tough days of a saturated market are upon them.

Take advantage of dedicated training and support

Access to training resources and on-demand support is vital for operators in new markets. While every market is different, those with expertise in the cannabis industry can rely on the past to predict the first few years of a market. By taking advantage of dedicated training and support designed for operators in new markets, cannabis retailers can learn from the triumphs and pitfalls of other markets, replicate successes and lessen the blows of mistakes. Savvy operators like advocacy groups like the CAURD Coalition in New York have partnered with industry experts like Treez for advice and training.

Looking Ahead:

New cannabis markets like New Jersey and New York are open for business and poised for immediate growth but at the same time, face the looming possibility of a saturated market down the road. Before they’re caught slipping as competition increases and supply begins to meet demand, operators must be proactive in understanding customer groups and adapting their strategies accordingly. By focusing on brand differentiation, customer experience, data utilization, and ongoing training, operators in new markets can increase their chances of long-term success.

Market 2: Saturated

Examples: Massachusetts, Illinois, Michigan

Grade: C+ (with ability to get to B and above if they course correct quickly)

Our second identified market is found in states like Massachusetts, Illinois, and Michigan, where the cannabis market has reached a point of saturation. These states experienced a period of growth and success when they were new and emerging markets. However, as the supply and demand curve started to flatten, operators in these states began to face challenges. More retailers opening provided choice for consumers and drove down the price of cannabis products.

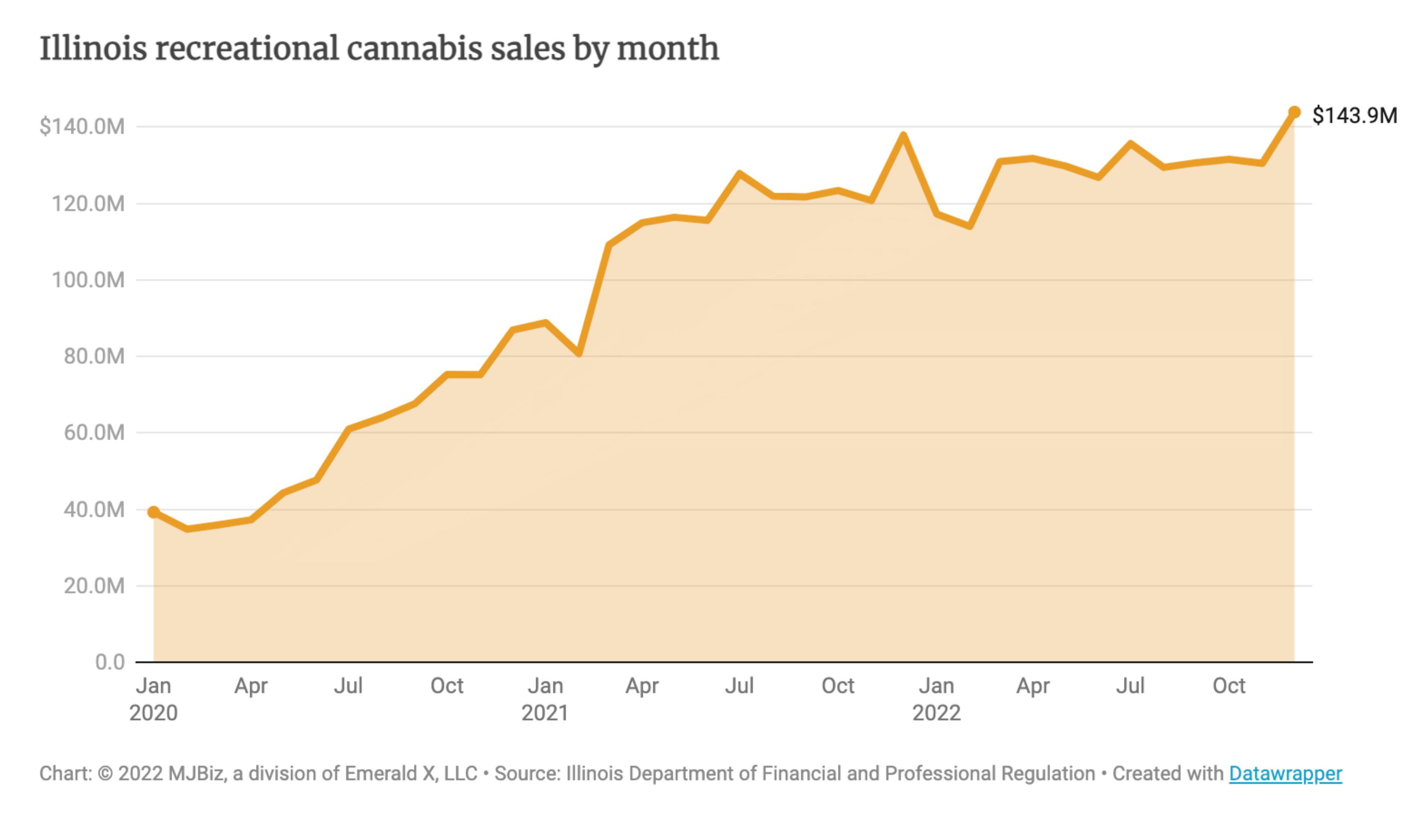

According to MJBizDaily, Massachusetts sees about $132.6M monthly in rec sales and another $21.9M monthly in medical sales. Illinois, as a whole, is selling about $143.9M in recreational sales and $31.4M in medical. Michigan’s cannabis market takes in slightly more per month, $208.3M in recreational and 13.4M in medical. Especially given the age and size of the markets, these figures are not indicative of a huge market plummet, but rather, a bloating and slowing of markets.

The reality is that many operators went live without future-proofing their businesses, riding the wave of an initial booming market without leveraging operational best practices that would lead to long-term success. The technology solutions they chose to use at the onset were sufficient when customer demand was high and margins were favorable. However, as times have become challenging, operators are looking around and realizing that they lack the necessary tools and systems to operate efficiently in a tougher, saturated market.

To survive these circumstances, operators in saturated markets need to make adjustments to their operating procedures and processes. They have to course-correct to get back on the path to growth and profitability. Luckily they still can if they act quickly.

The More-than-Basics

A market arrives at its saturated state because too many processes and business decisions are following the basic option or choice. To dig themselves out of a saturated market will require better than average choices. For that reason, we’re categorizing all our recommendations for saturated markets as more-than-basic.

Data

Operators should jump to capture any data they can, to gain custom insights into their business that can’t be found in any advice article or how-to. Quality data can help operators understand vital things about their business and identify the opportunities for improvement. Treez Retail Analytics, for example, lets retailers access and act on data within moments on important aspects of business operations like

Cashless Payments

By implementing cashless payments, operators can also take a hold of their success. When a customer has the ability to use a debit card or linked bank account instead of cash, operators get out of their own way and let customers buy as much product as they want. Budtenders are empowered to upsell without concern of needing to void the entire transaction so the customer can take out more cash. When retailers implement several cashless payments options, they see a sustained increase in average order value, which means more profit in the short term and more predictable sales in the future.

Loyalty Programs & Promotions

Another best practice that retailers in saturated markets should be sure they are following is to implement strategies to build a loyal customer base. That could mean encouraging customers to return within 7 days through a coupon or discount code that is only redeemable in the next week.

Retailers who want more visibility into their customers behavior while also building brand affinity should go beyond the basics of coupons and deals to implement a loyalty program. With a program that integrates with their point of sale system, a retailer can incentivize high dollar transactions by defining how many points a customer receives in their branded loyalty program per dollar they spent.

In a market in dire need of a course correction, the most successful operators will upgrade to quality technology, and use market expertise and their own customer and operational data to strategize, pivot, and pull through treacherous times.

Market 3: Oversaturated

Examples: California, Colorado

Grade: D (must overcorrect ASAP, get to healthier margins and back to growth)

Within our third category are two of the OGs of legal cannabis sales: California and Colorado. Even though (or maybe because) they are synonymous with cannabis to even the most casual observer of the industry, CA and CO are oversaturated markets and are facing the most significant challenges of all. Operators in these states face intense competition, price wars, and challenges in maintaining profitability. Let’s also not forget the recent changes in excise taxes in California that have compounded the already stifling taxation that plagues cannabis retailers and businesses at large. On top of that, the illicit market continues to be prevalent despite efforts to curb them, leading to even further struggles for regulated businesses to succeed.

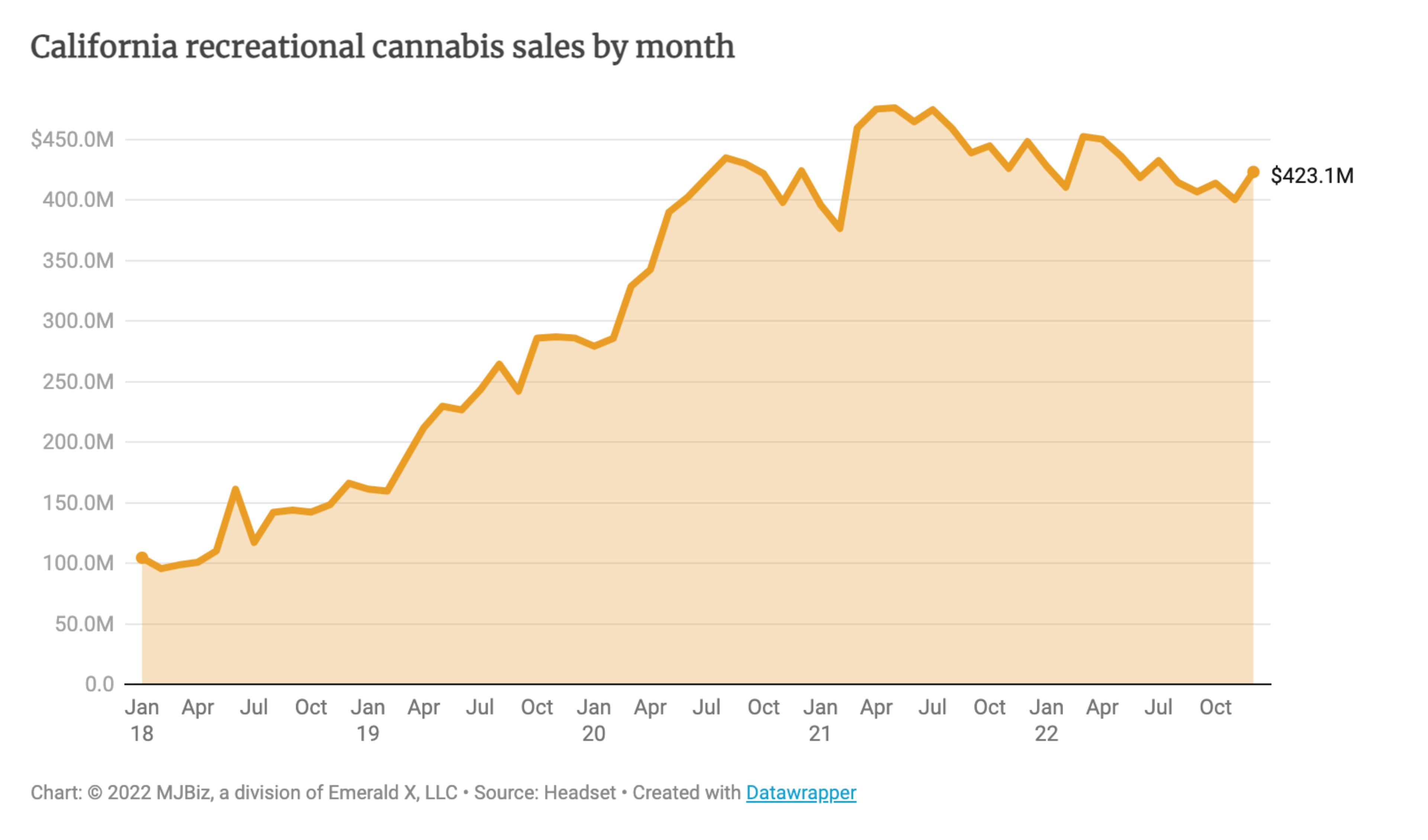

The California industry as a whole rakes in $423.1M in recreational sales monthly while monthly cannabis sales in Colorado land at just about $120M total ($113.9M in rec sales added to $16.4M in medical sales monthly). These numbers may seem gargantuan in terms of sheer economic force represented, but monthly sales have leveled out or dipped more than a healthy market would.

As MJBizDaily puts it “Colorado [had] seen its cannabis sales mature into predictable seasonal patterns influenced by tourism although that has been upended recently by the COVID-19 pandemic and economic downturn.”

Many operators in these states are struggling to stay afloat and are trying to cut costs as a means of survival. Unfortunately, in an oversaturated market, things could get worse for retailers before they get better. Simply cutting costs without fixing their operational woes won’t be enough.

But even operators who find themselves making up the lower 50% of market performers have the opportunity to not only just remain in business. With strategic decisions based on current market conditions and true product performance , even the lowest performers can right their path and achieve better margins and growth.

To overcome the challenges of an oversaturated market, operators must identify areas where they can cut back effectively, as well as, ways to increase revenue to get their margins to a healthier state and ultimately drive to profitability. The most expensive line items on a ledger sheet are labor and products that don’t move, and require steep discounts in order to sell, thus eating into margins.

To achieve better efficiency, operators should focus on several metrics - sellable velocity, which can show plainly what products are moving off a shop’s shelves with speed, and which are languishing; transaction time, which can identify top performing and efficient budtenders; and average order value, which can identify the star upsellers amongst your sales associates. By zeroing in on successful products and eliminating cost centers related to slow-moving inventory and excessive labor, operators can regain their growth trajectory and increase revenue.

Operators in oversaturated markets currently have a grade of D, indicating a dire need to overcorrect and not settle for mediocrity in their business. By leveraging the proper tools and capabilities operators can make informed decisions, optimize their operations, and improve their chances of success in a challenging market environment.

The More-than-Basics

Despite the extremely difficult market in states like California and Colorado, some operators have charted their own success by going beyond the basics.

Megan's Organic Market has a brand that stands out while evoking the familiar. Their logo is an updated take on a classic neon storefront sign, and their brand name simultaneously evokes neighborhood familiarity and high quality. The store evokes a classic grocery market, with products that customers can get close to and even pick up. The joyful vintage vibes and brand voice carry over to their social media and their website too.

When MOM’s faced inconsistent data quality, unreliable uptime, and incompatible workflows from their point of sale system, they invested in higher quality software in 2021 and doubled their sales. The retailer has also now expanded to three storefront locations with more locations planned.

Megan’s Organic Market is a fixture in their community. The retailer was recently named The Best Dispensary of SLO County for the third year in a row. It’s clear MOM’s makes an effort to garner local press, not just in the cannabis industry, but in publications that appeal to their target market.

When Herb Shoppe in Colorado audited their own operations, they found tons of opportunities to improve their efficiency, which led to leaps in profitability and customer satisfaction. Herb Shoppe’s story sounds like a lot of operators in oversaturated markets like California and Colorado, and more recently in saturated markets like Illinois, Michigan, and Massachusetts too.

When Herb Shoppe came under new management and took a harder look at their operating procedures and technology partners, and found they were lacking in visibility, big time. Without an intuitive way to see how discounts, tax, and cost of goods impacted their bottom line, previous management had been making decisions in the dark. Herb Shoppe charted their own path to profitability by taking a hard look at their business, investing in their data and teaming up with reliable and compliance-obsessed technology partners.

Both of these examples show that, even if a market looks grim and oversaturated, profitability is still within reach, provided a retailer is committed to providing a fantastic and differentiated customer experience, and to consistently leveling up their operations.

No One-Size-Fits-All Means to Success

There’s no singular cannabis market in the United States or a one-size-fits-all method to achieve success. There are just too many factors at play. For one, the consumption and sale of cannabis is still federally illegal, as are interstate cannabis sales. State markets vary distinctly based on the market’s age and maturity, as well as the types and variety of consumer profiles represented in the buying public. The differences between state regulations and compliance requirements also play a major role in cannabis market behaviors.

Across all the different market conditions the cannabis industry faces, both now and in the future, Treez will work alongside retailers to future-proof their cannabis businesses and overcome profitability challenges. Whether operators are in new or emerging markets, saturated markets, or oversaturated markets, Treez tools like Retail Analytics, cashless payment options, and expert guidance help operators navigate challenges, optimize operations, and increase their chances of long-term success.

Want to have a deeper conversation about your state’s cannabis market and how Treez can help ensure success?