Why Cannabis Retailers Should Combat a Cash-First Industry

When legalized cannabis sales began in the United States, accepting cash was a retailer’s singular option. Even businesses taking in $15,000+ a day were required to operate only in cash.

Being tethered to cash isn’t a necessary evil anymore. The cannatech industry has found several solutions to replace dangerous and clunky cash-only sales. Even so, some operators haven’t added enhanced payment options to their offerings. Vetting new payment options for a dispensary can be tough, but here are some reasons why retailers should be combatting a cash-first industry.

Being Cash-Only Is A Liability

Because cannabis is federally regulated in a restricted category, banks have thus far refused to take on the liability of facilitating finances in cannabis operations.Instead, operators and their staff have been forced to shoulder the liability of handling and storing thousands of dollars on-site. Robberies of dispensaries in states like Colorado, Washington, Massachusetts and elsewhere continue to rise year over year. Staff with minimal security must transport cash to the bank, sometimes multiple times a day, vulnerable to bad actors. Even armored vehicles used for cannabis cash transports are subject to attack. Bills often have to be paid in cash, taxes too. Dispensaries can reduce the cash on-site at their locations by up to 30% by implementing cashless payments. After implementation, back of house staff focuses more on in-store tasks instead of errands to the bank. Budtenders spend more of their time providing the customer service they’re known for, instead of counting cash or giving change. Stores using cashless payments will have reduced theft liability, with fewer opportunities for robberies or cash being diverted by bad actors.

Cannabis Customers Want to Use a Card

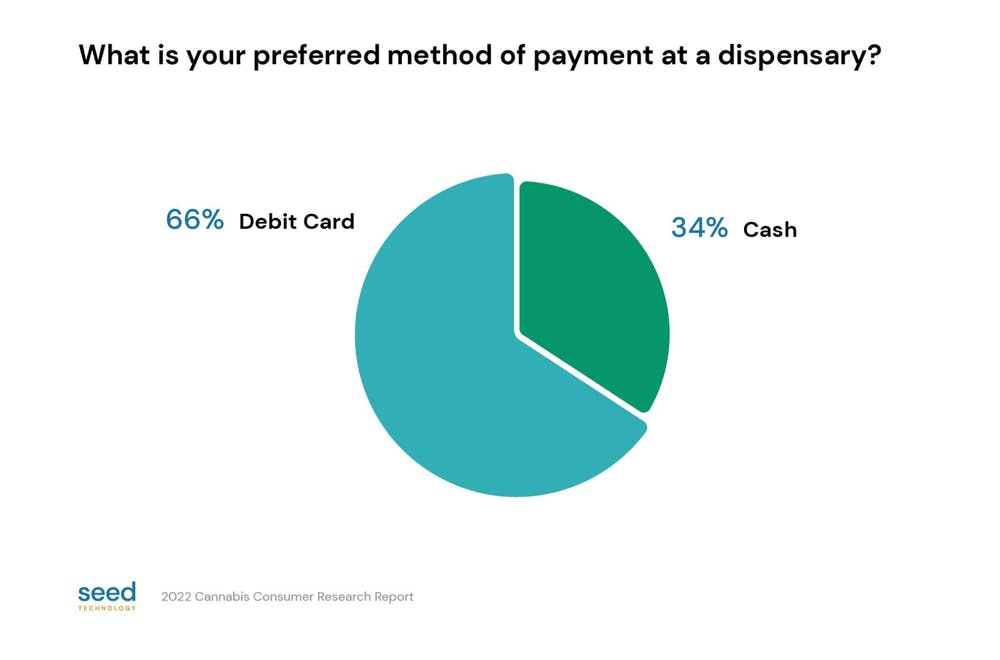

In a preliminary study by Seed Technology, sixty percent of surveyed shoppers said their preferred method of paying was with a card.

Only a third of dispensary customers surveyed said they preferred to shop using cash at a dispensary. Digging deeper into the survey data, Seed Technology found an unexpected reason why some answered in favor of cash: As they answered, some said they had a particular dispensary in mind, which only takes cash.

The data seems to show that most customers would use a card if it was presented as an option. And even the most loyal customers wish their cash-only haunts would upgrade to cashless payments.

Because There are Other Options Out There

There are several choices besides cash for dispensaries looking to provide payment options for their customers. Broadly, those are:

PIN Debit

At the time of purchase, a customer uses their debit card issued by their bank, and provides their PIN number to authorize the payment. PIN Debit provides the customer an experience similar to their other daily shopping.

Retailers greatly reduce the possibility of fraud and chargebacks with PIN Debit. That’s because these charges require a shopper to enter a 4 digit PIN to authenticate the purchase. PIN Debit is also the fastest payment solution, with funds removed from a customer’s account immediately and available within a 24-hour turnaround time.

Shops that offer PIN Debit see their ticket values increase by an average of $10-$20, per transaction. Customers are more likely to add extras to their cart when the choice to do so is so simple and easy!

ACH (Automated Clearing House)

With ACH, customers connect their bank account to their customer profile one time and are able to seamlessly transfer funds from their bank to purchase goods. Shoppers can use ACH to check out in-store as well as pay for preorder/pickup and online orders. ACH is, in general, preferred by customers who make large or online orders or loyally shop at your store. Single visit walk-in customers may not be easily convinced to commit the time to connect to ACH, so it's wise to offer several payment options.

Cashless ATM

Cashless ATM has been a payment workaround some dispensaries have used where consumers pull their bank funds via their debit card. In Dec. 2022, more than one-fifth of the dispensary industry was thrown for a loop when one avenue that CATM payments traveled on was abruptly shut off. Though CATM technically is still in use in the cannabis industry, it is a less preferred workaround with other safer, more compliant options in existence.

Credit Cards

Until recently, there were no viable credit card solutions worth pursuing for compliance purposes, due to the overall risk of their transaction flow. This is becoming less of an issue as new and established payment players are entering the cannabis credit card space with novel, more compliant solutions.

Rather than blatantly defying card network rules, some payment solutions have adapted their models to process credit by means of closed loop systems. Closed loop allows the processors to personally accept credit payments in exchange for tokens or credits. These credits are then paid out in full to the merchant.

Because You’re Leaving Money on the Table

The numbers are really clear about this. However you determine your business’ monetary success, cashless payments can make a positive impact.

Cashless payments empower more people to shop at your store and to do so efficiently. That increases your total sales count for the day, through more customers through the door.

These same customers are able to spend more money. Customers have a 40% larger Average Order Value when they use cashless options.

More customers in the door, spending more money. Put those together you get increased overall revenue for your business.

Because Cash is Restrictive, Cashless is Freeing

After all the work you’ve done to get shoppers in the store, it doesn’t make sense to stall your customers’ shopping. Give them a chance to buy the products they want. Provide a customer experience that is conducive to impulse buys near the checkout counter and a well-timed upsell from a budtender.

Don’t restrict them to making purchases under a certain dollar amount. Don’t leave them fumbling with change, especially after a transaction is completed. Give them the option to swipe and go.

Because in Cannabis, Uneven Books = More than Just a Headache

Even the best managed cash drawers can come up uneven at the end of a busy day. The more payments that run through cashless payments like TreezPay in a day, the simpler your books will be to resolve at closing time. Simpler daily operations mean you’re on the way to simpler yearly accounting.

Ward off compliance violations that come from messy, cash-heavy books by operating as cashless as possible.

Because No One Has Time for Cash

Every second counts in reducing wait times for your visitors. When new TreezPay clients come online, they see a reduction of average ticket times of up to 15%.

Customers appreciate almost a minute off their check out and a break from fumbling with cash. Budtenders don’t have to end a transaction or remove items from a cart if a customer comes up short on cash at the register. By adding cashless payment options like TreezPay, a dispensary prevents a stalled transaction and clogged checkout line for minutes while a customer “runs to the ATM” in the middle of a purchase.

On your busiest days, your lines will move faster, getting more people through check out and preventing walk outs.

Because the Right Experts Exist to Help You Pick the Right Payments for Your Operation

Since 2018, Treez has provided vetted, integrated, and redundant cashless payment solutions to our customers. We are proud to offer both integrated PIN Debit and ACH payments to provide your customers with a seamless shopping experience.

It’s time for the cannabis industry to step into an elevated, easier shopping experience for all. By adding one or more cashless payment opportunities to their roster, cannabis retailers can stay on the cutting edge of the industry while reducing their liability and customer wait times.

Ready to upgrade to secure and seamless payments built with your dispensary in mind?

Ready to upgrade to secure and seamless payments built with your dispensary in mind?

Current Treez customers, reach out to your CSM to learn more about upgrading your cashless payment options.